SASSA tells NET1 to retract “misleading” pamphlet

Company told to apologise to social grant beneficiaries

The South African Social Security Agency (SASSA) has given Grindrod Bank and Net1 five days to retract a “misleading” pamphlet being distributed to social grant beneficiaries across the country.

SASSA accounts have for the last six years been held at Grindrod Bank on behalf of Cash Paymaster Services (CPS), which used to pay all the social grants. Net1 is the parent company of CPS and of EasyPay Everywhere, the company which issues green cards to grant beneficiaries for private bank accounts. Net1 also owns credit provider Moneyline, and beneficiaries wishing to take out a loan are expected to take out a green card.

There are currently more than two million grant beneficiaries with green cards. The number spiked in recent months as the contract between SASSA and CPS drew to an end, with activists warning that Net1 might intend to maintain its loan and other business with grant beneficiaries through the green cards once its contract expired.

The contract ended in March this year. CPS will continue to manage the distribution of cash payments until September, but the more profitable electronic payments to over five million recipients will now be made by SASSA or the South African Post Office.

The new SASSA Postbank cards are expected to be distributed in May. Beneficiaries will be required to bring the relevant document to their nearest SASSA or Post Office to apply for the new card.

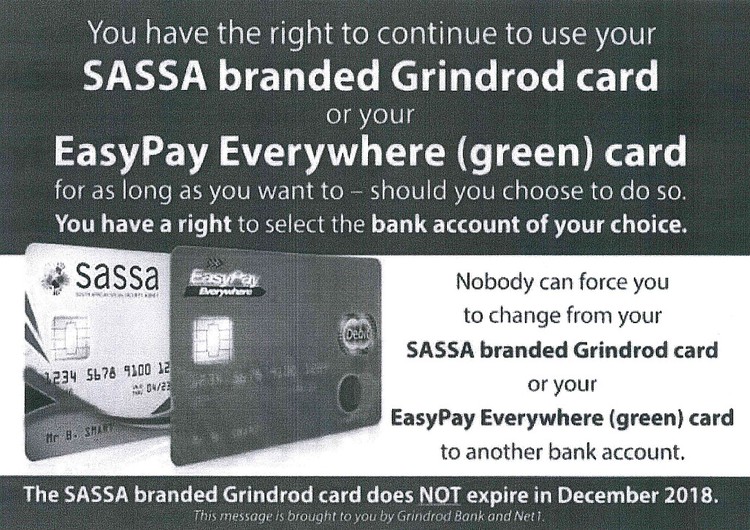

The pamphlet issued by Net1 has a photo of the current SASSA card and the green EPE card on it. Beneficiaries are told: “You have the right to continue to use your SASSA branded Grindrod card or your EasyPay Everywhere (green) card for as long as you want to - should you choose to do so.” Next to the photo of the cards is the statement: “Nobody can force you to change from your SASSA branded Grindrod card or your EasyPay Everywhere (green) card to another bank account” and “The SASSA branded Grindrod card does not expire in December 2018.”

This is the Net1/Grindrod Bank advert that SASSA has said must be withdrawn.

On 23 April, SASSA acting CEO Pearl Bhengu in a letter told Net1 to retract the pamphlet.

In her letter Bhengu referred to the pamphlet as “misleading” because it depicts the EPE card as one of SASSA’s banking accounts “of choice”. “The EPE card has not been endorsed and/or backed by SASSA”, she said.

Bhengu warned Net1 not to market the EPE cards in SASSA offices or at SASSA cash pay points.

“The rules which apply to any commercial bank also apply to you as a bank.”

“We request that you immediately cease with the distribution of the pamphlet and retract the misleading information together with an apology to the beneficiaries,” Bhengu wrote.

Questions sent to Net1 on Tuesday morning were acknowledged but had not been answered by midday on Wednesday.

Support independent journalism

Donate using Payfast

Next: Vrygrond residents to restart land occupation

Previous: Community consent is not needed for mining rights, says lawyer

© 2018 GroundUp.

This article is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.

You may republish this article, so long as you credit the authors and GroundUp, and do not change the text. Please include a link back to the original article.